Market in Canada

The period of the COVID-19 epidemic and the financial vulnerability of many Canadian households have opened up opportunities to understand better the impact of these shocks on the household budget and strengthen the resilience of the household budget. Using data on Canadians’ financial condition and providing products and services related to making appropriate financial decisions enhance the productivity of their current and future planning.

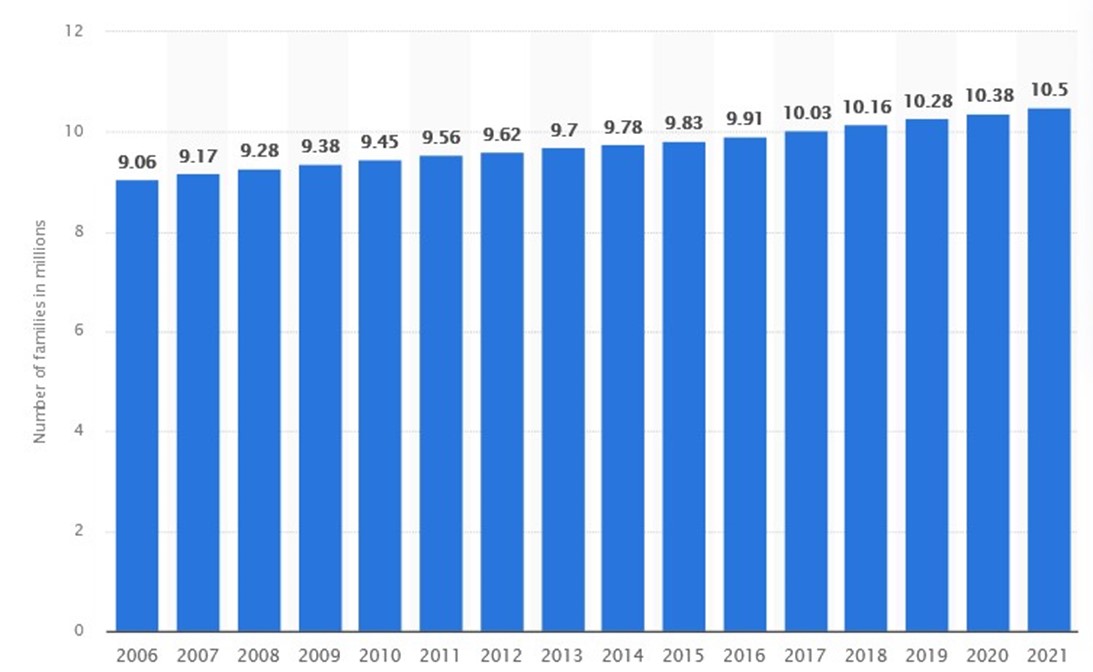

According to the above, the goal of this startup is to develop a mobile application so that families can more easily and better plan their finances for their savings, investments, and daily life. Based on the above, the number of families in Canada is recognized as one of the target markets of this startup. According to statistics reported by Statista, the number of Canadian families in 2021 is estimated at 10.5 million. The figure below illustrates the total number of Canadian households from 2006 to 2021. However, this high number only represents families, and many people who can use this application are single.

Number of families in Canada from 2006 to 2021 (in millions)

On the other hand, the willingness of Canadians based on surveys and surveys conducted in 2019 by the Canadian Financial Capability Survey (CFCS) shows the strong desire of Canadians to budget and carry out activities related to cost management. Based on this, it can be predicted that the Canadian people will welcome the market for such products in the coming years.

North America accounted for 41% of total market revenue in 2017 and will continue to do so until 2023. One of the main reasons for this is that the leading players in the advanced solutions in this region’s financial software market can offer their services.